Metro Phoenix Housing Update: September 2024

Hi, it’s Michael Hankerson. Today is October 1st 2024, and I have the latest Metro Phoenix housing numbers along with some key national economic indicators to share with you.

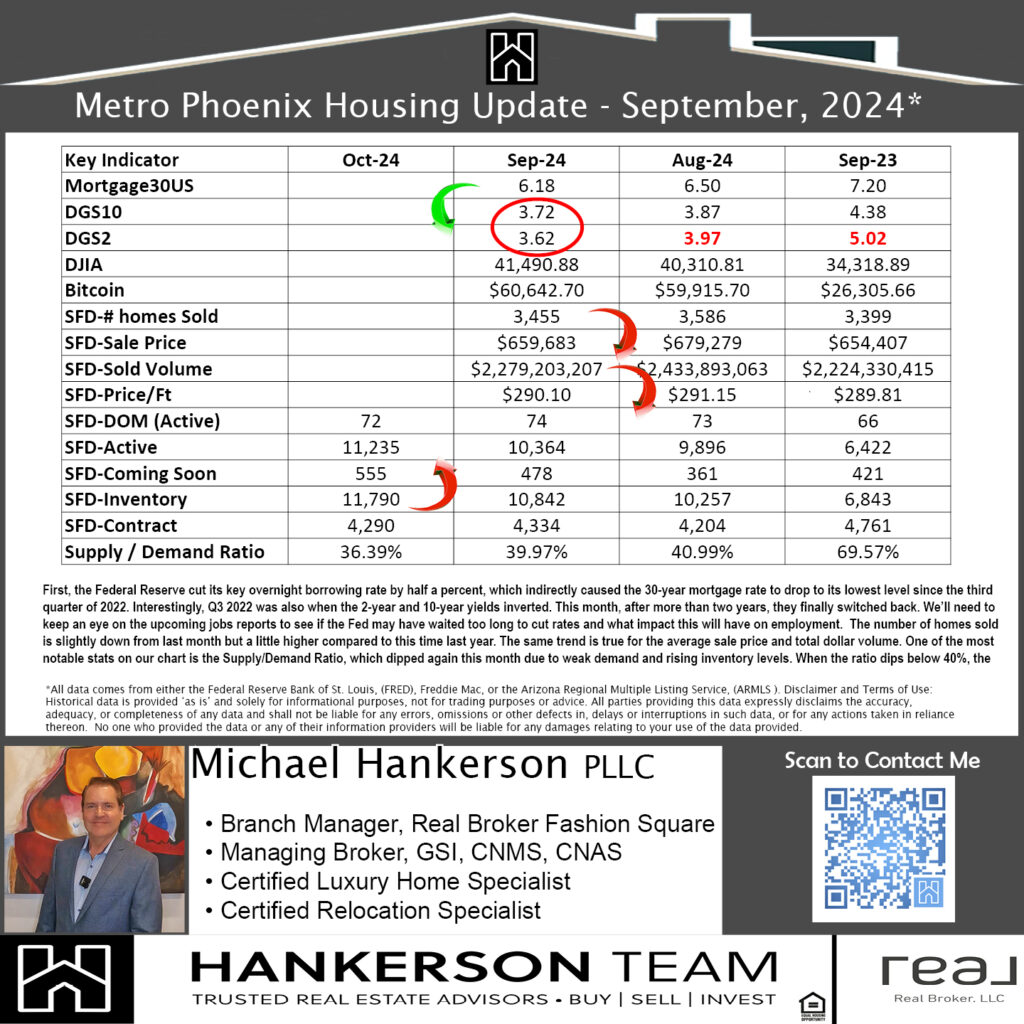

First, the Federal Reserve cut its key overnight borrowing rate by half a percent, which indirectly caused the 30-year mortgage rate to drop to its lowest level since the third quarter of 2022. Interestingly, Q3 2022 was also when the 2-year and 10-year yields inverted. This month, after more than two years, they finally switched back. We’ll need to keep an eye on the upcoming jobs reports to see if the Fed may have waited too long to cut rates and what impact this will have on employment.

The number of homes sold is slightly down from last month but a little higher compared to this time last year. The same trend is true for the average sale price and total dollar volume.

One of the most notable stats on our chart is the Supply/Demand Ratio, which dipped again this month due to weak demand and rising inventory levels. When the ratio dips below 40%, the market typically favors buyers in contract negotiations. This was the case for one of my clients last Friday when we closed on a home. We successfully negotiated a 5.5% reduction in the asking price and secured a $1,725 credit for repairs. (You can read more about it here https://newhomes-az.com/time-for-a-change/.)

It will be interesting to see if the combination of reduced interest rates and increased inventory leads to a boost in demand, which is currently very soft.