Metro Phoenix Housing Update – May 2025

There’s nothing dramatic to report this month, but the concerns I’ve been watching over the past few months have all gotten slightly worse.

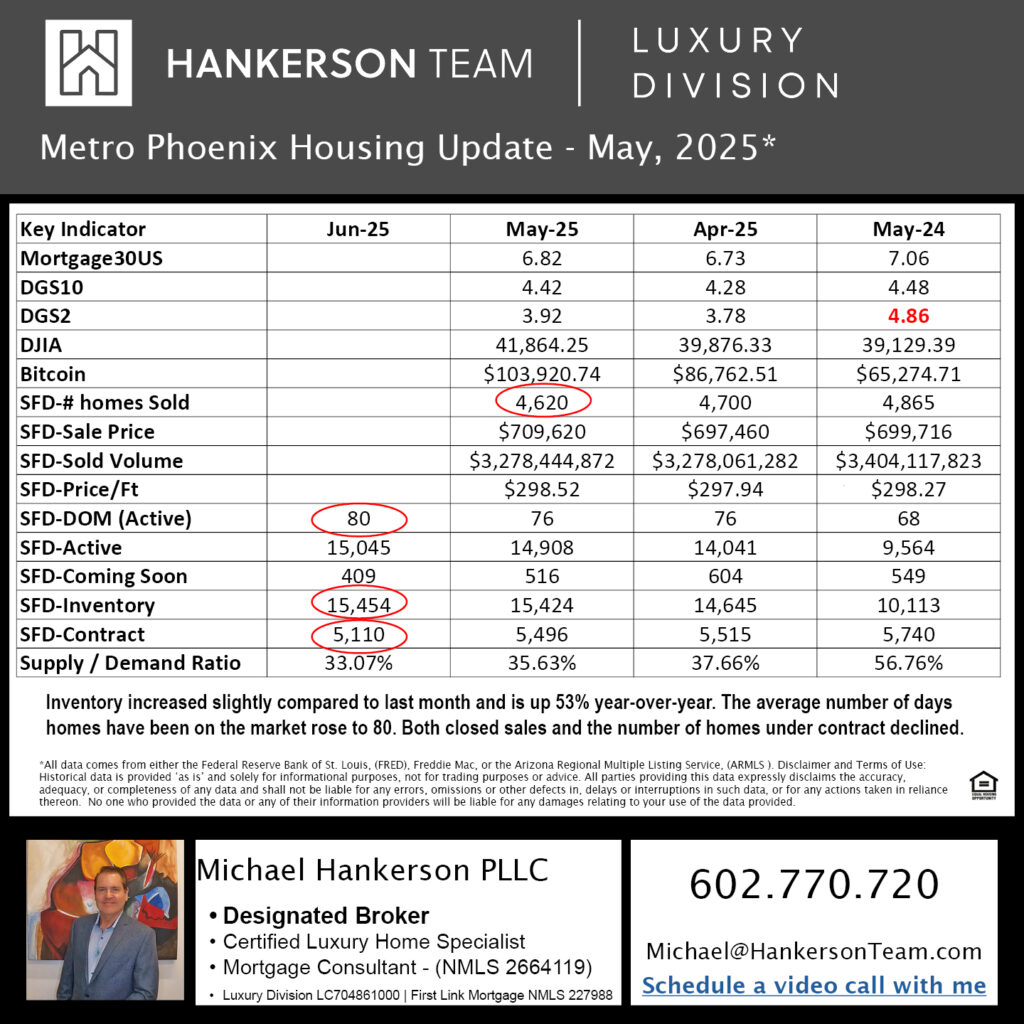

Supply ticked up modestly—just 30 additional homes, which isn’t significant on its own—but overall inventory is now up 53% compared to this time last year. The bigger concern is demand: both the number of homes under contract and the number of sales in May declined, both month-over-month and year-over-year. I believe this trend will likely continue through July, if not the entire summer. A drop in interest rates could help shift that trajectory.

The average sale price technically rose, but if you remove two high-end sales—one at $30 million and another at $17 million—the average was essentially unchanged. Meanwhile, the average number of days homes have been on the market rose to 80, which is notably high.

Two key indicators that impact the luxury market—the Dow Jones Industrial Average and Bitcoin—are both performing well. The DJIA is up both month-over-month and year-over-year. Bitcoin saw a nearly 20% increase from last month and is up 59% from a year ago, which often correlates with increased luxury real estate activity.

Both the 30-year mortgage rate and the 10-year Treasury yield have risen. Most forecasts now project between one and four rate cuts this year, with two or three being the most likely. The number and timing of those cuts will directly impact buyer demand and could help reverse some of the softening we’re seeing.

As a reminder, I’m also a licensed mortgage broker (NMLS #2664119), with access to over 20 direct lenders and banks. This ensures you always have multiple options to save money. Our full range of loan products and streamlined online application process make securing your mortgage simple, efficient, and cost-effective. Start the process of getting a loan. https://link.my1003app.com/2664119/inquiry