Metro Phoenix Housing Update | December 2025

It is Friday, January 2, 2026, and while the final numbers are not fully locked in yet, we have more than enough data to clearly understand what happened in December and where the Metro Phoenix housing market stands today.

At first glance, the market appears confusing, because several key indicators are signaling something very different than what most people would expect.

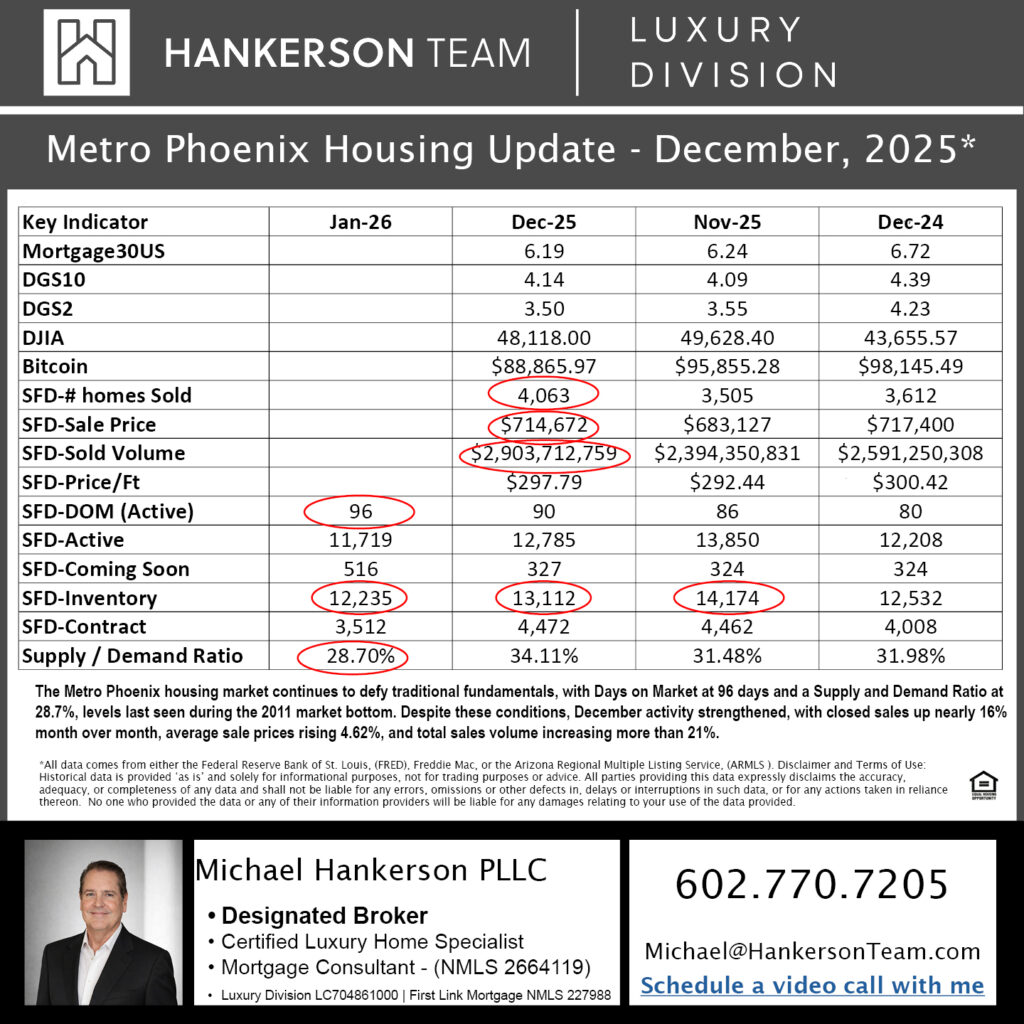

Currently, Days on Market is sitting at 96 days, and the Supply and Demand Ratio is at 28.7%. These are levels we have not seen since the bottom of the last housing downturn in 2011.

That timeline is important to understand.

The housing crash began in 2008, but home prices did not bottom immediately. Prices continued to decline for nearly three additional years, finally reaching their lowest point in 2011. From that point forward, home values across the Phoenix metro area have, for the most part, risen steadily for more than a decade.

So when today’s data resembles 2011 conditions, it does not mean we are at the beginning of a crash like 2008. It means certain market indicators are sitting near levels that historically marked a market bottom. That is why many people assume prices should be falling sharply.

Under normal circumstances, they would be.

If you are not familiar with how the Supply and Demand Ratio works or why it matters, we explain that in detail here:

https://newhomes-az.com/extreme-buyers-market-balanced-market-and-extreme-sellers-market-explained/

However, despite what these indicators would traditionally suggest, prices are not falling.

In fact, December showed clear signs of strength.

- The number of homes sold increased nearly 16% from November to December, rising to 4,063 closed sales.

- Total sales volume increased more than 21%, climbing to $2,903,712,759.

- At the same time, the average sale price increased 4.62% to $714,672.

These numbers matter because they show buyers are not just present in the market. They are actively purchasing homes and doing so at higher overall price points.

In a typical market cycle, a 96-day average Days on Market combined with a sub-30% Supply and Demand Ratio would usually lead to widespread price reductions. Instead, buyer demand has remained strong enough to support pricing, even as inventory has increased and homes are taking longer to sell.

One factor helping support demand is financing.

The 30-year mortgage rate is currently around 6.19%, which is near its lowest level of the past couple of years. While this rate is still higher than what buyers experienced during the ultra-low rate environment, it represents a meaningful improvement from recent highs and has helped bring some buyers back into the market by improving affordability and qualification.

Another trend that was widely expected is now clearly showing up in the data.

A significant number of homes are being taken off the market. Nationwide, it is projected that approximately 175,000 homes will expire in January 2026. In Arizona specifically, there are already about 1,000 fewer homes for sale in January than there were in December, and nearly 2,000 fewer than in November.

This reduction in active listings is important because it helps relieve some of the excess supply that built up over the past year. Fewer homes on the market can help stabilize pricing, especially when buyer demand remains steady.

This is also why no single statistic should ever be viewed in isolation.

We track 15 key market indicators to understand where the Phoenix housing market is actually headed, including supply, demand, pricing trends, buyer behavior, absorption rates, and momentum shifts. If you would like to learn more about those indicators and why each one matters, you can read more here:

https://newhomes-az.com/15-key-stats-that-reveal-where-the-phoenix-housing-market-is-headed/

The bottom line is that today’s market feels confusing because it is being influenced by competing forces. Higher inventory and longer selling times suggest cooling, while rising prices, increased sales volume, improving mortgage rates, and homes being removed from the market continue to provide support.

Understanding the context behind the data is far more important than reacting to any single headline.

If you have any questions, please feel free to reach out to me by phone or text at 602.770.7205.

#LinkBrokerages