Metro Phoenix Housing Market Update Q1-2024

2021 to 2023

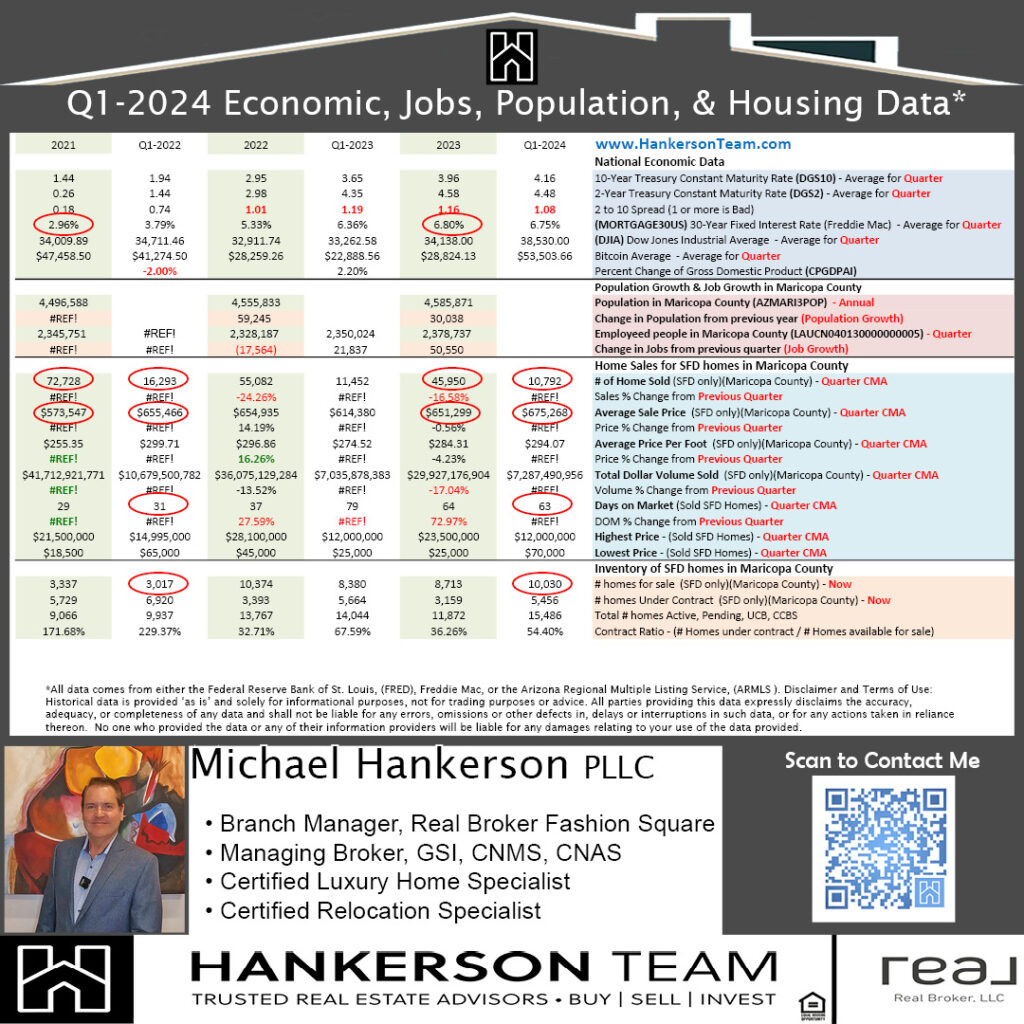

- Average 30-Year Mortgage Rate up 130%

- Number of homes Sold down 37%

- Average Sale Price up 14%

Q1 2021 to Q1 2024

- Number of homes Sold down 34%

- Average Sale Price up 3%

- Average Price Per Foot down 2%

- Average Days on Market up 103%

- Inventory of Homes for Sale up 232%

The dynamics of real estate markets can often seem counterintuitive at first glance, especially when considering how different factors interact over time. The increase in the average sale price of homes by 14% from 2021 to 2023, despite a significant rise in mortgage rates and a decrease in home sales, can be attributed to several factors:

- Supply and Demand Dynamics: Even with an overall decrease in the number of homes sold, there can still be a high demand relative to the available supply, especially in desirable locations. This demand can drive up prices. It’s important to note that while the inventory of homes for sale has increased significantly by 2024, this statistic reflects a later period; the inventory levels might have been lower or not meeting demand adequately during the earlier phase of 2021 to 2023.

- Inflation and Construction Costs: General inflation can affect home prices by increasing the costs associated with building and maintaining properties. Construction materials, labor, and land costs have been rising, which contributes to higher prices for new homes, subsequently pushing up the overall average sale price of homes.

- Low Inventory in Previous Years: Leading into 2021, many markets were experiencing historically low inventory levels, which had been pushing prices up for several years. Even as the number of sales decreased due to higher mortgage rates, the momentum of price increases could carry forward due to the low baseline inventory and high competition for available homes.

- Changing Homebuyer Preferences: The COVID-19 pandemic initiated a shift in homebuyer preferences, with more people looking for homes that offer additional space for home offices, outdoor areas, and other amenities. This shift increased the demand for certain types of homes, contributing to an increase in average sale prices despite broader market headwinds.

- Low Mortgage Rates at the Start: It’s also crucial to remember that while mortgage rates have increased significantly, they started at near-historic lows. The initial low rates enabled many buyers to enter the market, driving up prices until the rates began to impact affordability negatively.

- Market Segmentation: The real estate market is highly segmented by geography, property type, and price range. While some segments may experience price declines, others can see price increases due to specific local factors, such as job growth, migration patterns, and changes in the economic landscape.

Overall, the real estate market’s response to changes in mortgage rates, inventory levels, and other economic factors is complex. The interaction of these variables can lead to seemingly paradoxical outcomes, such as prices rising amid declining sales and increasing mortgage rates.