The Metro Phoenix Housing Market Is Bumpy

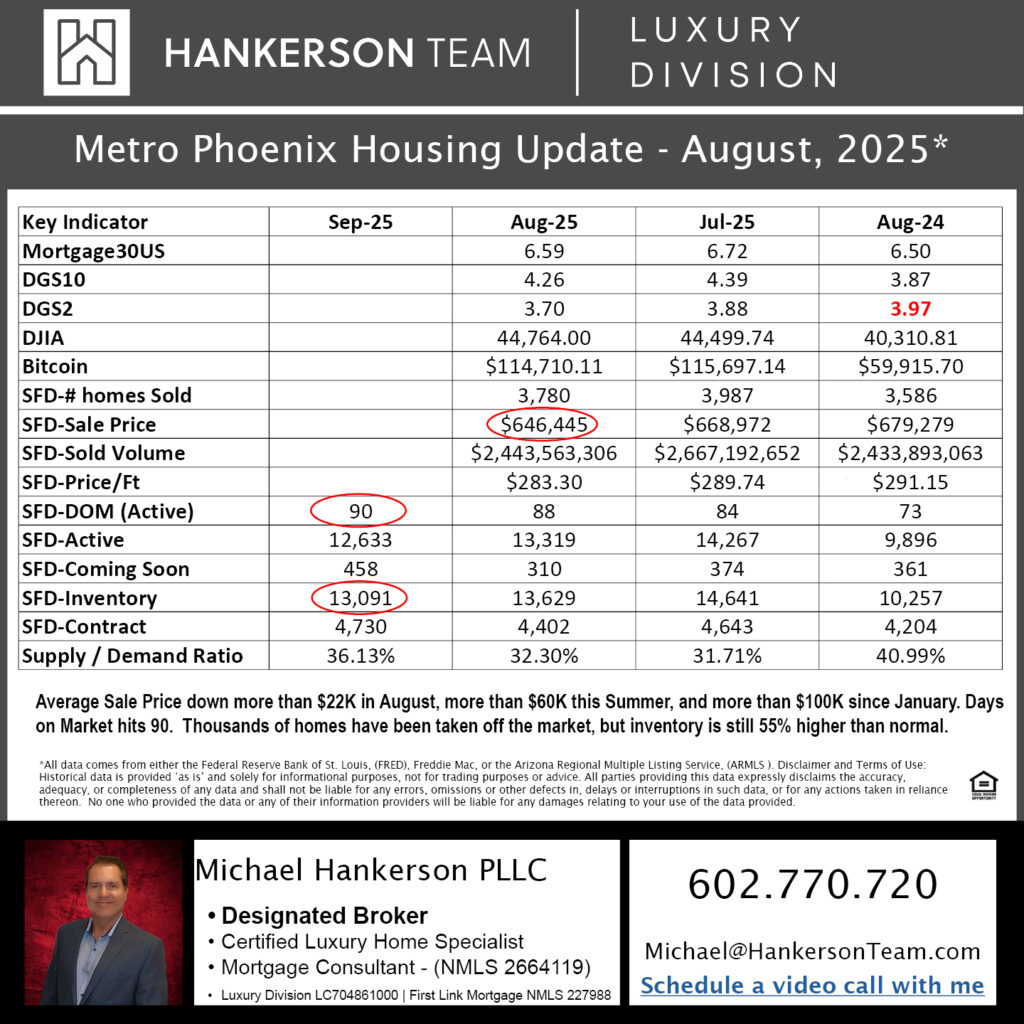

Here’s what’s happening right now in the Metro Phoenix housing market. The average sale price of single-family detached homes sold on the MLS in Maricopa County is dropping fast:

- Down more than $22,000 in August

- Down more than $60,000 this summer

- Down more than $100,000 since January

- Days on Market now sits at 90

So, who’s happy about this? Nobody.

- Sellers are frustrated that they missed the peak and wish they had accepted offers back in January. Many are pulling their listings, with total inventory down by more than 2,000 homes this summer.

- Buyers are discouraged by high interest rates and disappointed that prices haven’t fallen further.

What’s Next With Rates?

I don’t control the Fed, but current projections point to two or more rate cuts before the end of 2025. We’re already seeing the 10-year Treasury yield and 30-year mortgage rates begin to come down.

If mortgage rates drop, here’s what to expect:

- Thousands of buyers will restart their home searches.

- Thousands of sellers will put their homes back on the market.

Here’s the tricky part: more buyers and more listings could initially balance each other out, so don’t expect prices to spike right away. Well-priced, move-in-ready homes should sell quickly, while overpriced homes may still linger.

Currently, inventory is about 55% higher than historical norms. That means buyers who are prepared when rates fall will still have plenty of options. Over time, as this surplus gets absorbed, prices are likely to climb again. Phoenix remains attractive thanks to its strong economy, steady population growth, and relative affordability compared to West Coast cities.

Success Story

One of my buyers just closed on a Camelback Mountain home for $1,750,000, the same property the seller turned down at $1,950,000 in January.

I also have two listings that went under contract at full list price. We priced them correctly, but even then, buyers are pushing back, frustrated at paying full price in this market. The result? One contract canceled, while the other is clear to close next week.

Want to Be Ready?

If you’d like to get pre-qualified so you can act quickly when rates come down, you can start the process here: