Inside the Numbers: How to Read the Metro Phoenix Housing Update

Each month, Michael Hankerson—Designated Broker for the Luxury Division, Mortgage Broker with First Link Mortgage (NMLS #2664119), and team lead for the Hankerson Team—tracks and publishes the Metro Phoenix Housing Update, a report featuring 15 key national economic and local housing indicators.

The report captures a snapshot of current market conditions on the first of each month by tracking six key indicators: days on market, active listings, coming soon listings, inventory, homes under contract, and the supply/demand ratio. Then, the report analyzes the month being reported by adding five national economic indicators and four Metro Phoenix housing statistics related to sales. These figures are then compared to the previous month and the same month one year prior to identify trends and market shifts. By analyzing these trends, we gain a clear view of where the market stands today—and where it may be headed.

Clients and followers use this data to make more informed decisions about buying, selling, or investing in Metro Phoenix residential real estate. A standout example is the May 2022 report, which warned that housing inventory had more than doubled in just 60 days. Based on that insight, I advised an investor to delay a purchase and encouraged a seller to list in May instead of waiting until July. These strategic decisions helped avoid losses—and in some cases, saved tens of thousands, if not over $100,000.

Meanwhile, iBuyers who continued paying full price into the summer suffered major losses by fall, as inventory quadrupled and the average sale price dropped nearly $80,000.

Questions?

📅 Book a call with Michael Hankerson

📊 Why This Report Matters to You

Most housing reports you see in the news are backward-looking. They tell you what happened last month or last quarter—but they don’t tell you where the market is heading. That’s like trying to drive forward while looking in the rearview mirror.

This report is different. It doesn’t just explain the past—it helps forecast what’s next.

Whether you’re planning to buy, sell, or invest, understanding momentum in the market can help you:

- Avoid overpaying or overpricing

- Spot good opportunities before others do

- Time your move with more confidence

- Make smarter decisions backed by facts, not fear

🧠 Behind Every Stat Is a Smart Strategy

Each of the 15 indicators in this report has a purpose. They help answer questions like:

- “Will mortgage rates rise or fall?”

- “Is now a good time to list—or should I wait?”

- “Are buyers gaining leverage—or are sellers still in control?”

- “How quickly are homes selling—and how long might mine sit?”

- “Are luxury buyers active—or holding back?”

These aren’t just numbers—they’re tools. When you understand them, you can see what others miss.

Questions?

📅 Book a call with Michael Hankerson

Here are the 15 Key Indicators—and why they matter to real estate agents, buyers, sellers, and investors in the Metro Phoenix housing market:

- Mortgage30US (30-year fixed mortgage rate)

Why it matters: This directly impacts buyer affordability and monthly payments. Higher rates can reduce demand, slow sales, and lower prices. Investors calculate cash flow with this rate, and agents use it to gauge urgency. - DGS10 (10-year Treasury yield)

Why it matters: A benchmark for mortgage rates. Rising yields signal future rate hikes, potentially slowing buyer demand. It’s a leading indicator for market shifts. - DGS2 (2-year Treasury yield)

Why it matters: Reflects short-term economic sentiment. If the 2-year yield exceeds the 10-year (an inversion), it can signal a potential recession—impacting buyer caution, investor strategies, and seller pricing. - DJIA (Dow Jones Industrial Average)

Why it matters: A broad measure of economic health. Luxury buyers and investors often react to stock market performance. Strong markets fuel confidence; downturns cool high-end sales. - Bitcoin

Why it matters: In high-net-worth circles, Bitcoin serves as a liquidity source. When prices surge, cash home purchases often rise—especially in the luxury sector. - SFD-# Homes Sold (Single Family Detached)

Why it matters: A measure of buyer activity and market health. Lower sales can indicate waning demand or affordability issues. Helps agents and sellers track market competitiveness. - SFD-Sale Price

Why it matters: Shows price trends. Buyers assess market timing, sellers set listing strategies, and investors monitor appreciation or decline. - SFD-Sold Volume

Why it matters: Represents the total dollar value of homes sold. A drop might reflect fewer high-end sales or an overall market slowdown. - SFD-Price/Ft

Why it matters: Levels the field across home sizes. Buyers evaluate value, sellers price strategically, and investors run projections for flips or rentals. - SFD-DOM (Active) – Days on Market

Why it matters: Indicates how long listings sit unsold. Rising DOM can mean declining demand or unrealistic pricing—helpful for setting expectations and negotiation strategies. - SFD-Active Listings

Why it matters: A snapshot of available homes. An increase can suggest a shift to a buyer’s market, prompting sellers to adjust pricing or incentives. - SFD-Coming Soon

Why it matters: Offers insight into future supply. Buyers and agents can act early. Sellers can time their listings better, and investors may spot early opportunities. - SFD-Inventory (Months of Supply)

Why it matters: Shows how long it would take to sell all active listings at the current pace. Under 3 months = seller’s market. Over 6 = buyer’s market. Vital for timing and strategy. - SFD-Contracts

Why it matters: Reflects how many homes are going under contract in real time. Often a leading indicator before closed sales show the trend. Helps forecast shifts in demand. - Supply / Demand Ratio

Why it matters: This metric defines the market dynamic. When supply exceeds demand, buyers gain leverage. When demand exceeds supply, sellers hold the advantage. Critical for all real estate decisions.

What it measures:

The Supply / Demand Ratio (formerly called the Contract Ratio) compares the number of homes actively listed for sale to the number of homes currently under contract. In simple terms, it tells you how much buyer activity exists relative to available inventory. It’s one of the few indicators that provides a real-time snapshot of market momentum.

How to interpret it:

- A ratio of 90% or more is typically considered an Extreme Seller’s Market—homes sell quickly, often with multiple offers or bidding wars.

- A ratio between 50% and 60% represents a Balanced Market, where neither buyers nor sellers have a strong advantage.

- A ratio of 30% or less reflects an Extreme Buyer’s Market, where homes sit longer, prices soften, and buyers hold most of the negotiating power.

Want to understand how this ratio affects pricing, negotiation, and timing?

For a deeper dive into how the Supply/Demand Ratio shapes real estate strategy—and why it’s one of the most forward-looking tools in the market—read our detailed article: Extreme Buyer’s Market, Balanced Market, and Extreme Seller’s Market—Explained.

Questions?

📅 Book a call with Michael Hankerson

#LinkBrokerages

Metro Phoenix Housing Market Updates

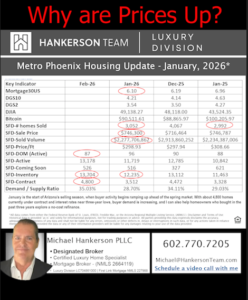

Metro Phoenix Housing Market Update January 2026

Inventory is up and days on market is high, so why are home prices increasing?

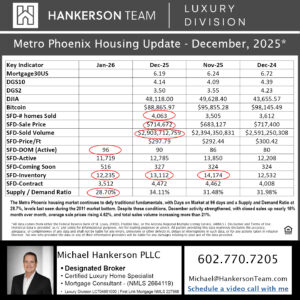

Metro Phoenix Housing Update | December 2025

The housing market in the Metro Phoenix area is behaving almost exactly opposite of what traditional market fundamentals would suggest. Days on Market currently sits at 96 days, and the Supply and Demand Ratio is at 28.7%. These are levels we have not seen since the bottom of the 2008 housing crash in 2011.

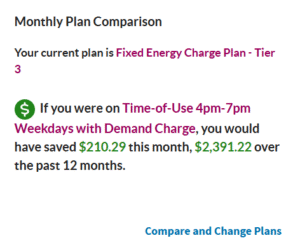

You Might Be Wasting Thousands on the Wrong APS Electric Plan

Most homeowners assume a high electric bill is just part of living in Arizona. But in many cases, the real issue is not usage, it is the electric plan itself. A quick comparison can reveal thousands of dollars in unnecessary costs hiding in plain sight.

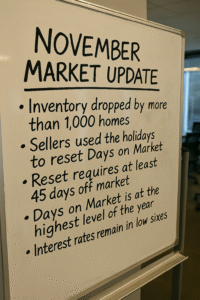

November Metro Phoenix Housing Market Update

The November numbers show a clear holiday-season shift. Inventory dropped by over one thousand homes, Days on Market hit its yearly high, and interest rates held steady in the low sixes — creating a slower but more predictable market as we close out the year.

How to Save Money When Buying a Home in Arizona

Finding the home does not save you money. What happens next does. Here is what buyers need to know before making an offer.

Don’t Make This Mistake When Buying a Home

Many buyers believe that if they find the home online themselves and walk into an open house on their own, they should save money. It feels reasonable, but that is not how real estate works.

What actually saves you money is experience.

An experienced agent understands the market, understands the contract, guides the process, and knows how to negotiate the four areas that matter most:

2 Responses