Some Very Interesting Things Happened in August

Metro Phoenix Housing Update for August 2024

Hi, it’s Michael Hankerson. Today is September 4th, and something very interesting happened last month regarding the national economic numbers and the local Metro Phoenix housing market.

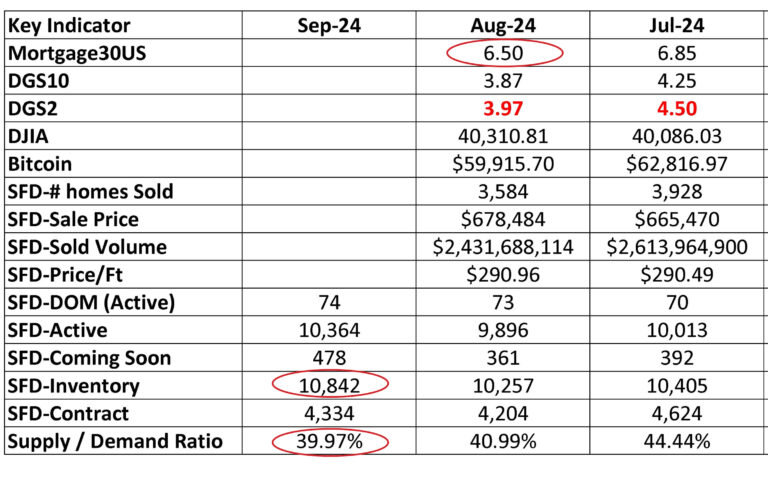

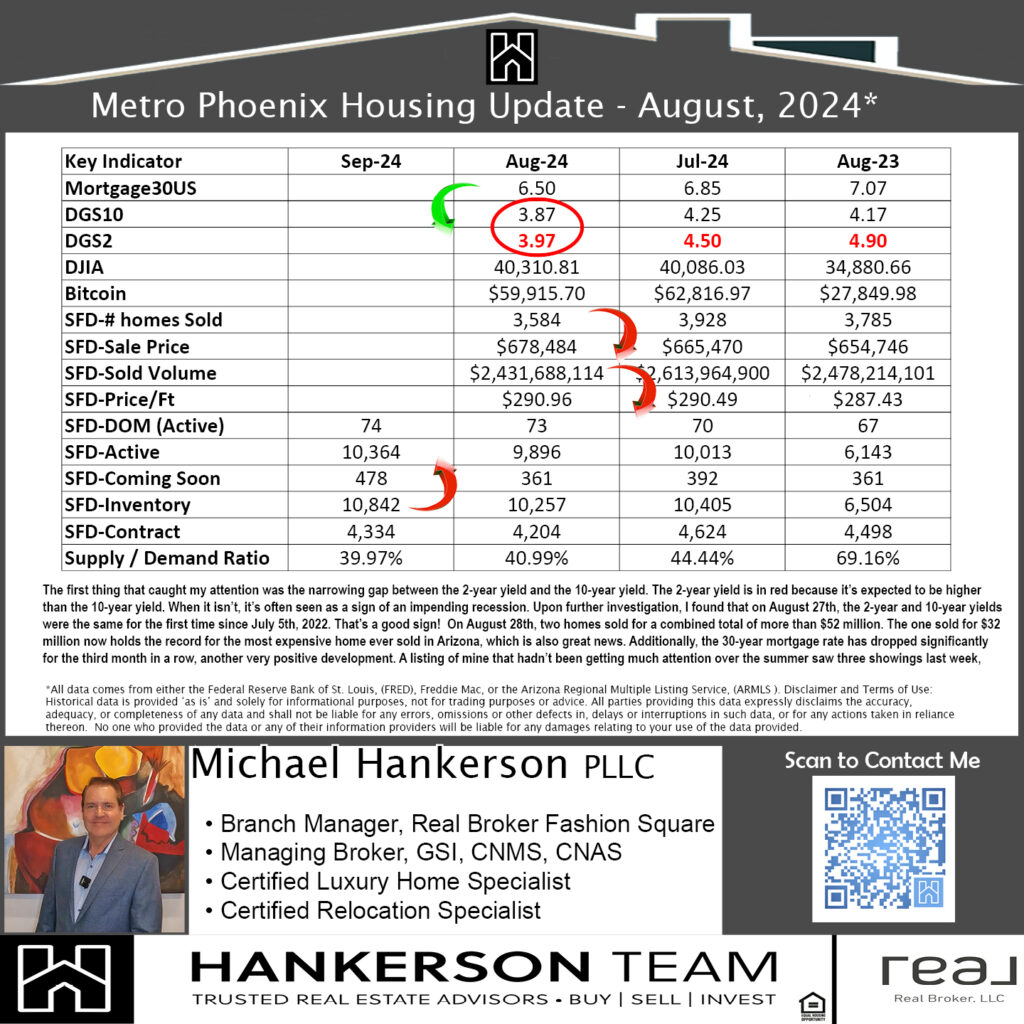

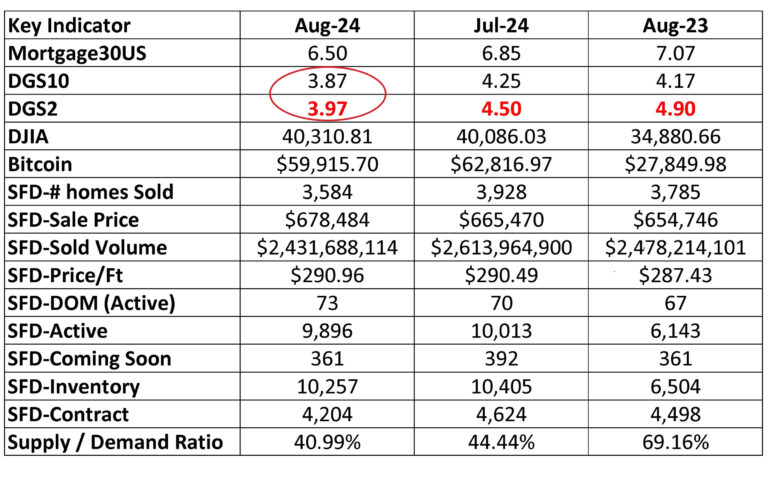

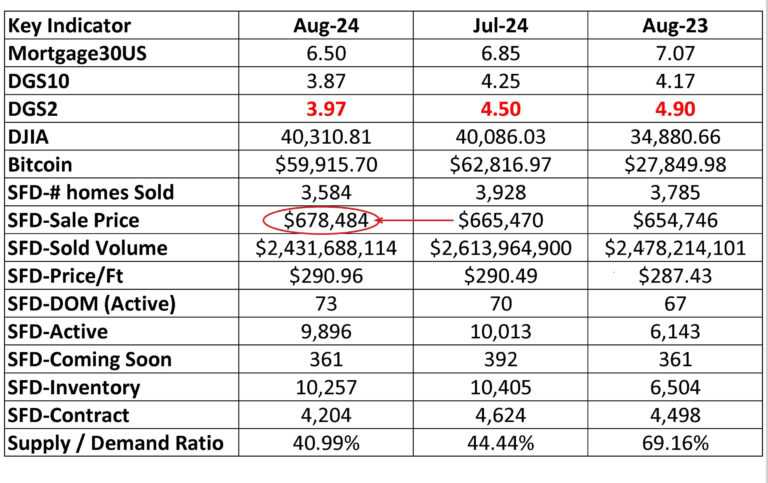

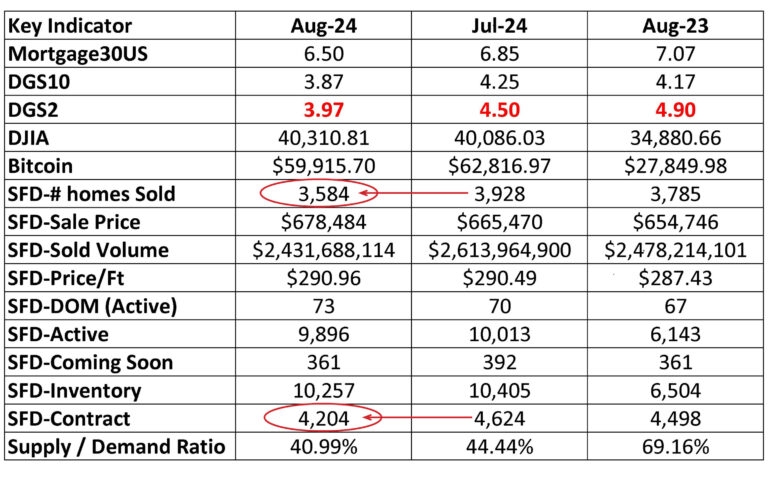

The first thing that caught my attention was the narrowing gap between the 2-year yield and the 10-year yield. The 2-year yield is in red because it’s expected to be higher than the 10-year yield. When it isn’t, it’s often seen as a sign of an impending recession. Upon further investigation, I found that on August 27th, the 2-year and 10-year yields were the same for the first time since July 5th, 2022. That’s a good sign!

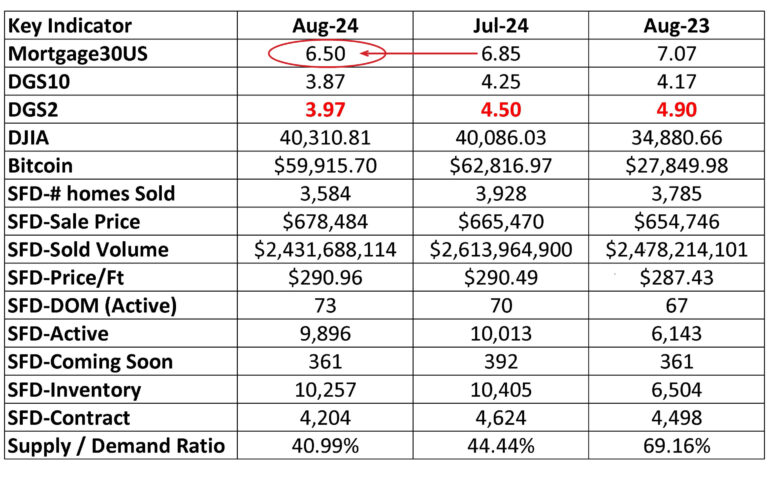

On August 28th, two homes sold for a combined total of more than $52 million. The one sold for $32 million now holds the record for the most expensive home ever sold in Arizona, which is also great news. Additionally, the 30-year mortgage rate has dropped significantly for the third month in a row, another very positive development. And listing of mine that hadn’t been getting much attention over the summer saw three showings last week, resulting in two full-price offers—yet more good news.

While the average sale price appears to have increased, if we exclude the three homes that sold for a combined total of over $72 million, the average sale price actually declined. As I predicted last month, based on the number of homes under contract, the total number of homes sold has decreased, as has the total dollar volume. The housing inventory is at its highest level in 2024, causing the supply-demand ratio to dip below 40% for the first time this year. This, combined with lower interest rates, could make the market more favorable for buyers.

If you have any questions, feel free to reach out to me via direct message, text, phone call, or email at 📞602.770.7205 or [email protected].

The first thing that caught my attention was the narrowing gap between the 2-year yield and the 10-year yield. The 2-year yield is in red because it’s expected to be higher than the 10-year yield. When it isn’t, it’s often seen as a sign of an impending recession. Upon further investigation, I found that on August 27th, the 2-year and 10-year yields were the same for the first time since July 5th, 2022. That’s a good sign!

On August 28th, two homes sold for a combined total of more than $52 million. The one sold for $32 million now holds the record for the most expensive home ever sold in Arizona, which is also great news. Additionally, the 30-year mortgage rate has dropped significantly for the third month in a row, another very positive development. And listing of mine that hadn’t been getting much attention over the summer saw three showings last week, resulting in two full-price offers—yet more good news.

While the average sale price appears to have increased, if we exclude the three homes that sold for a combined total of over $72 million, the average sale price actually declined. As I predicted last month, based on the number of homes under contract, the total number of homes sold has decreased, as has the total dollar volume.

The housing inventory is at its highest level in 2024, causing the supply-demand ratio to dip below 40% for the first time this year. This, combined with lower interest rates, could make the market more favorable for buyers.