Inside the Numbers: How to Read the Metro Phoenix Housing Update

Each month, Michael Hankerson—Designated Broker for the Luxury Division, Mortgage Broker with First Link Mortgage (NMLS #2664119), and team lead for the Hankerson Team—tracks and publishes the Metro Phoenix Housing Update, a report featuring 15 key national economic and local housing indicators.

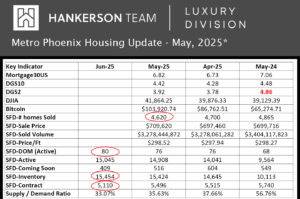

The report captures a snapshot of current market conditions on the first of each month by tracking six key indicators: days on market, active listings, coming soon listings, inventory, homes under contract, and the supply/demand ratio. Then, the report analyzes the month being reported by adding five national economic indicators and four Metro Phoenix housing statistics related to sales. These figures are then compared to the previous month and the same month one year prior to identify trends and market shifts. By analyzing these trends, we gain a clear view of where the market stands today—and where it may be headed.

Clients and followers use this data to make more informed decisions about buying, selling, or investing in Metro Phoenix residential real estate. A standout example is the May 2022 report, which warned that housing inventory had more than doubled in just 60 days. Based on that insight, I advised an investor to delay a purchase and encouraged a seller to list in May instead of waiting until July. These strategic decisions helped avoid losses—and in some cases, saved tens of thousands, if not over $100,000.

Meanwhile, iBuyers who continued paying full price into the summer suffered major losses by fall, as inventory quadrupled and the average sale price dropped nearly $80,000.

Questions?

📅 Book a call with Michael Hankerson

📊 Why This Report Matters to You

Most housing reports you see in the news are backward-looking. They tell you what happened last month or last quarter—but they don’t tell you where the market is heading. That’s like trying to drive forward while looking in the rearview mirror.

This report is different. It doesn’t just explain the past—it helps forecast what’s next.

Whether you’re planning to buy, sell, or invest, understanding momentum in the market can help you:

- Avoid overpaying or overpricing

- Spot good opportunities before others do

- Time your move with more confidence

- Make smarter decisions backed by facts, not fear

🧠 Behind Every Stat Is a Smart Strategy

Each of the 15 indicators in this report has a purpose. They help answer questions like:

- “Will mortgage rates rise or fall?”

- “Is now a good time to list—or should I wait?”

- “Are buyers gaining leverage—or are sellers still in control?”

- “How quickly are homes selling—and how long might mine sit?”

- “Are luxury buyers active—or holding back?”

These aren’t just numbers—they’re tools. When you understand them, you can see what others miss.

Questions?

📅 Book a call with Michael Hankerson

Here are the 15 Key Indicators—and why they matter to real estate agents, buyers, sellers, and investors in the Metro Phoenix housing market:

- Mortgage30US (30-year fixed mortgage rate)

Why it matters: This directly impacts buyer affordability and monthly payments. Higher rates can reduce demand, slow sales, and lower prices. Investors calculate cash flow with this rate, and agents use it to gauge urgency. - DGS10 (10-year Treasury yield)

Why it matters: A benchmark for mortgage rates. Rising yields signal future rate hikes, potentially slowing buyer demand. It’s a leading indicator for market shifts. - DGS2 (2-year Treasury yield)

Why it matters: Reflects short-term economic sentiment. If the 2-year yield exceeds the 10-year (an inversion), it can signal a potential recession—impacting buyer caution, investor strategies, and seller pricing. - DJIA (Dow Jones Industrial Average)

Why it matters: A broad measure of economic health. Luxury buyers and investors often react to stock market performance. Strong markets fuel confidence; downturns cool high-end sales. - Bitcoin

Why it matters: In high-net-worth circles, Bitcoin serves as a liquidity source. When prices surge, cash home purchases often rise—especially in the luxury sector. - SFD-# Homes Sold (Single Family Detached)

Why it matters: A measure of buyer activity and market health. Lower sales can indicate waning demand or affordability issues. Helps agents and sellers track market competitiveness. - SFD-Sale Price

Why it matters: Shows price trends. Buyers assess market timing, sellers set listing strategies, and investors monitor appreciation or decline. - SFD-Sold Volume

Why it matters: Represents the total dollar value of homes sold. A drop might reflect fewer high-end sales or an overall market slowdown. - SFD-Price/Ft

Why it matters: Levels the field across home sizes. Buyers evaluate value, sellers price strategically, and investors run projections for flips or rentals. - SFD-DOM (Active) – Days on Market

Why it matters: Indicates how long listings sit unsold. Rising DOM can mean declining demand or unrealistic pricing—helpful for setting expectations and negotiation strategies. - SFD-Active Listings

Why it matters: A snapshot of available homes. An increase can suggest a shift to a buyer’s market, prompting sellers to adjust pricing or incentives. - SFD-Coming Soon

Why it matters: Offers insight into future supply. Buyers and agents can act early. Sellers can time their listings better, and investors may spot early opportunities. - SFD-Inventory (Months of Supply)

Why it matters: Shows how long it would take to sell all active listings at the current pace. Under 3 months = seller’s market. Over 6 = buyer’s market. Vital for timing and strategy. - SFD-Contracts

Why it matters: Reflects how many homes are going under contract in real time. Often a leading indicator before closed sales show the trend. Helps forecast shifts in demand. - Supply / Demand Ratio

Why it matters: This metric defines the market dynamic. When supply exceeds demand, buyers gain leverage. When demand exceeds supply, sellers hold the advantage. Critical for all real estate decisions.

What it measures:

The Supply / Demand Ratio (formerly called the Contract Ratio) compares the number of homes actively listed for sale to the number of homes currently under contract. In simple terms, it tells you how much buyer activity exists relative to available inventory. It’s one of the few indicators that provides a real-time snapshot of market momentum.

How to interpret it:

- A ratio of 90% or more is typically considered an Extreme Seller’s Market—homes sell quickly, often with multiple offers or bidding wars.

- A ratio between 50% and 60% represents a Balanced Market, where neither buyers nor sellers have a strong advantage.

- A ratio of 30% or less reflects an Extreme Buyer’s Market, where homes sit longer, prices soften, and buyers hold most of the negotiating power.

Want to understand how this ratio affects pricing, negotiation, and timing?

For a deeper dive into how the Supply/Demand Ratio shapes real estate strategy—and why it’s one of the most forward-looking tools in the market—read our detailed article: Extreme Buyer’s Market, Balanced Market, and Extreme Seller’s Market—Explained.

Questions?

📅 Book a call with Michael Hankerson

#LinkBrokerages

Metro Phoenix Housing Market Updates

Metro Phoenix Housing Update – May 2025

Inventory increased slightly compared to last month and is up 53% year-over-year. The average number of days homes have been on the market rose to 80. Both closed sales and the number of homes under contract declined.

15 Key Stats That Reveal Where the Phoenix Housing Market Is Headed

Wondering where the Phoenix housing market is headed?

We break down the 15 key stats that matter most—from mortgage rates and inventory to Bitcoin and luxury sales trends. Whether you’re buying, selling, or investing, these insights help you make smarter real estate decisions in Metro Phoenix.

Two $30 Million Deals Closed on the Same Day in Metro Phoenix

Two $30 Million Deals Closed on the Same Day in Metro Phoenix?

It happened on May 22nd — and that’s not all. Two major price drops could signal fresh opportunities.

👉 Click to see what it means for buyers, sellers, and investors.

Metro Phoenix Home Prices Drop $45K in 4 Weeks

The Metro Phoenix housing market just experienced a last-minute shift. A flurry of end-of-month closings helped rebalance the supply / demand ratio—improving conditions slightly for sellers. While the average sale price is still down—now nearly $45,000

As supply outpaces demand price reductions are common

As supply continues to outpace demand in the Metro Phoenix area—and with what I consider the end of the “season” approaching next weekend on Easter Sunday—motivated sellers are making significant price reductions to get their homes sold.

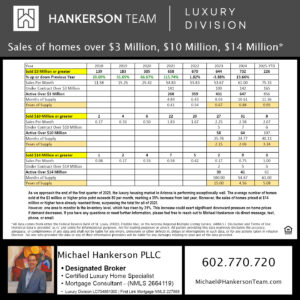

A Look Into Luxury April 5th 2025

Arizona’s luxury real estate market is on fire in early 2025! Sales of homes priced at $3 million and above are soaring, with over 80 properties moving each month—a stunning 35% increase from last year. The ultra-luxury segment is also setting records, with three homes over $14 million sold, already outpacing 2023’s total. Amidst this boom, rising inventory levels hint at potential shifts. Stay ahead of the market trends—contact Michael Hankerson for exclusive insights and personalized guidance.

2 Responses